- September 11, 2014

- by Prakash Lohana

- Articles

- 255 Views

- 0 Comments

In my earlier article “Why should you buy life insurance and how much?” I had tried to discuss and clarify on objective of life insurance and how much life insurance one should buy. It is being observed that investors buy life insurance policies which are mainly meant for investment or tax saving purpose and not for life insurance and this has a major negative impact on their wealth creation. So this article is an effort to bring some clarity on which type of life insurance policy you should buy.

In my earlier article “Why should you buy life insurance and how much?” I had tried to discuss and clarify on objective of life insurance and how much life insurance one should buy. It is being observed that investors buy life insurance policies which are mainly meant for investment or tax saving purpose and not for life insurance and this has a major negative impact on their wealth creation. So this article is an effort to bring some clarity on which type of life insurance policy you should buy.

For the understanding of layman investors, life insurance policies can be divided broadly in to three basic categories, which are discussed here under.

1.Term Insurance Policies: Term insurance policies are pure risk cover policy. In this type of plans, in case if insured person dies during policy term then a sum called sum assured is paid to the beneficiaries. But if insured person survives till the policy term then he will not get back anything. For instance, Mr. A buys a term insurance plan for 15 years for the sum assured of Rs. 10 lakhs. In this case if Mr. A dies during those 15 years then beneficiary is paid Rs. 10 lakhs but if he survives till completion of policy term (15 years) then he will not get anything.

These types of policies are life insurance policies in true sense because they offer very high life insurance cover at very low premium. Nowadays term insurance plans are also available in online mode. In online mode premiums are relatively lower than offline mode and you don’t need help of any agent or advisor.

2.Traditional Plans:Traditional plans are those types of life insurance policies which offer insurance and investment both. In this type of policies if insured person dies during the policy term then his beneficiary will get sum assured as agreed in policy and other benefits like accumulated bonuses in the policy. If insured person survives till the completion of policy period then he will get sum assured agreed in the policy and other benefits like loyalty addition and other bonuses.

Traditional Plans include traditional endowments, money back and lot of other policies. Normally, Traditional plans offer very low sum assured at high premiums so as a disadvantage one has to pay very high premiums to get higher sum assured.

3.Unit Linked Plan: Unit linked policies are plans where premium of insured person is divided in to three parts.

-First, a part of the premium goes to mortality charges. Mortality charges are the premium for life insurance.

-Second, a part of the premium goes to administrative charges like fund management charges, premium allocation charges, policy administration charges.

-Third part of the premium goes to investment in different asset classes like equity or debt and policy holder is allotted units for this amount.

Normally, in Unit Linked Plans, mortality charges are more or less close to premiums of term insurance plans. Here, if policy holder dies during the policy term, beneficiaries will normally get sum assured and fund value in the policy. And if policy holder survives till the policy term then he will get fund value in the policy. Fund value is decided on the basis of NAV of units allotted in that policy. These plans normally offer low insurance and high premiums and have administrative and other charges in the initial years due to which policy holder gets lesser units.

I strongly recommend investors to buy life insurance with clear cut objective of insurance and not investment or tax saving. Investors should draw a clear line between investment and insurance and when they are buying life insurance they should try to get maximum insurance at lower premium. Term insurance policies meet all these requirements.

At the first instance it seems that buying a term plan means losing all the money paid as premium whereas in Unit Linked Plans and Traditional plans will return your money with some returns earned on it. But think from other side that by buying term plan you have to pay very less premium so remaining money can be invested in any other better avenues like PPF, Fixed Deposits or Mutual funds to generate much higher returns. Let us compare two standard LIC traditional plan with a term plan and then see the difference in long term.

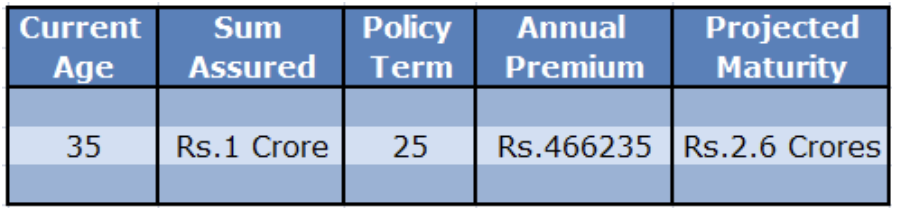

In above table I have tried to compare lic’s traditional New Jeevan Anand Plan – Table 815 with combination of Term Plan and alternative investment avenues. New Jeevan Anand policy is widely sold and bought nowadays so I have taken illustration of this policy.

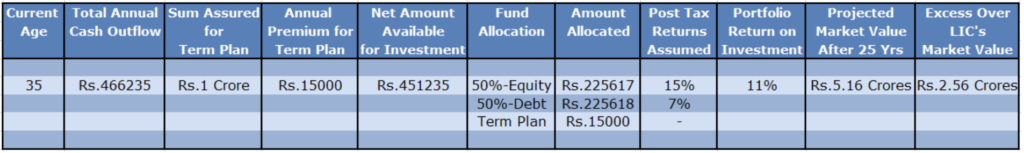

In above table age of the investor is 35, if he takes New Jeevan Anand plan Table -815 for 25 years for sum assured of Rs. 1 crore, his annual premium is Rs. 466235 and projected maturity at current bonus rates is approximately Rs. 2.60 crores. Please not that this maturity is not guaranteed because lic declares bonuses every year depending upon its profitability which are credited to policy holder’s account every year. Earlier these bonuses where very high but they are reducing almost every year. Now if alternatively investor buys an online term plan of 1 crore, his premium would be around Rs. 15000 annually. So after paying annual premium of Rs. 15000 he is left with Rs. 451235 (466235-15000=451235).

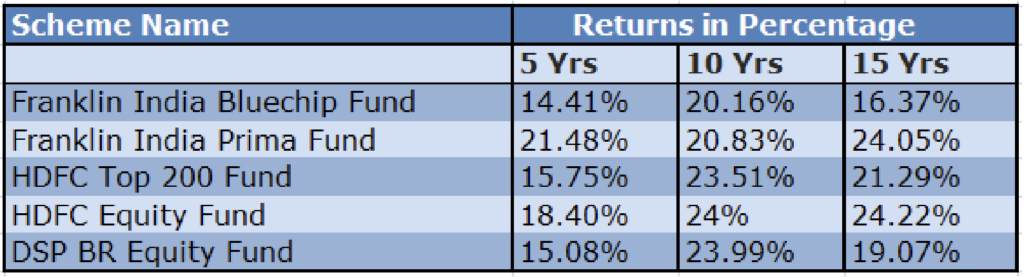

Now as this money is available for long term, we can invest 50% into Equity Mutual funds and 50% in to Bonds, Fixed deposit, PPF or any other fixed interest bearing product. We have assumed 15% Post tax returns in equity and 7% post tax returns in Bonds. So portfolio returns would be 11% p.a. With this, projected market value will come to Rs. 5.16 crores which is higher by Rs.2.56 crores from lic’s projected maturity. This is a big difference of around 98% more and almost double. Now question is whether equity mutual funds will give 15% p.a. returns over long term or not. Here at the end of this article I have given data of a few old equity mutual funds for reference, most of them have given more than 18% p.a. returns over long term. So here on a conservative side we are assuming 15% p.a. returns.

Other Disadvantages of Traditional Plans and ULIPs

a) Fixed commitment of Higher Premiums : Other disadvantage of traditional life insurance plans and ULIPs fixed long term contractual commitment of big premium amount. Because you need higher life insurance if you are buying traditional life insurance policies for higher sum assured you are taking fixed liability of higher premiums over long term as against this your fixed annual liability of premium remains low in term plans.

b) Poor Liquidity : Traditional plans also suffer with disadvantage of poor liquidity. When you need money invested in traditional plans you can only get loan and in ULIPs you can only get partial withdrawal. Whereas, if you taken term plan and invested remaining funds somewhere else the liquidity would be much better.

Here I have given chart below of Equity Mutual Funds for your reference.

To conclude with I would advise investors to leave their traditional mindset of buying traditional life insurance policies and ULIPs and buy term plans. Keep insurance and investment separate. This will help you in better wealth creation and buying higher life insurance cover at lower premiums.