- April 18, 2024

- by Prakash Lohana

- Articles

- 31 Views

- 0 Comments

The great Albert Einstein is believed to have once mentioned that those who understand it, earn it and those who don’t, pay it. It is crucial to comprehend what interest is, how compound interest works, and how to use it in daily life.

There is a beautiful explanation of the power of compound interest.Once there was a king, who wanted to reward a sage. He asked the sage to quote his prize. The sage requested the king to for one grain of rice. The confused king enquired, “Is that it?” The sage added, “Keep doubling the number of grains as you move forward from first square to the next. Put two grains on the next tile, then four grains on the next, and so on, so that each square has twice as many grains as the preceding one. They placed one grain on the first square, two on the next, four on the third, then eight, sixteen, thirty-two, sixty-four, and so on. The number began to appear to be far greater than the king had initially anticipated. With each new tile, it was growing tremendously. The king needed 2.1 billion grains of rice by the fourth row’s end. Now that he was getting worried, he requested his authorities to determine how much rice would be required overall to reward the sage. He was shocked to learn that the number of grains needed was much greater than the chessboard, his palace, and even his entire granary could hold.

Interested in knowing the total number of grains to fill up the chess board?

The amount was an astounding 18,446,744,073,709,600 (18 quintillion). Isn’t it amazing? That’s why compound interest is considered as the eighth wonder of the world. There are ‘n’ number of investment metrics in the world of finance but why is to so that this concept is given prime importance. Let’s go through its meaning first.

Compound interest is when you earn interest not only on the money you invested but also on the interest amount that money earns over time. This means that your money grows faster and faster the longer it’s invested. It helps your money to grow exponentially over a period of time.

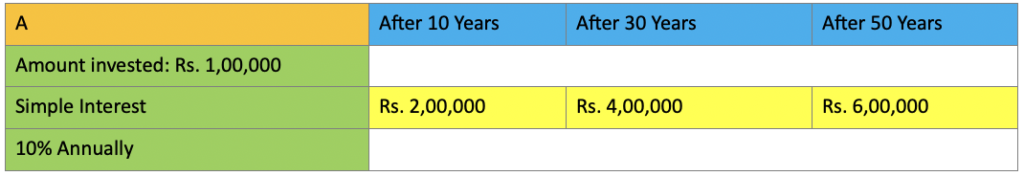

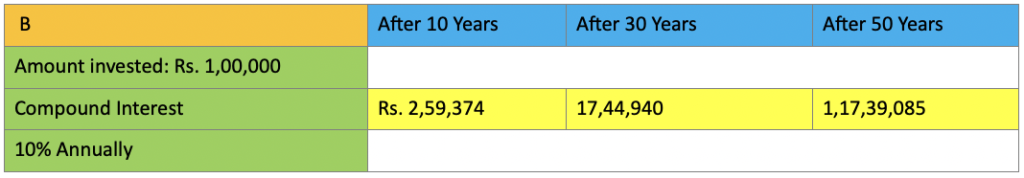

There are two types of interest: simple interest and compounding interest, let’s understand with the help of an illustration.

Suppose, there are two investors, A and B, both of them invest Rs. 1,00,000 each. The below table shows what they would accumulate over the years

Investor A’s returns are calculated considering the simple interest, while Investor B’s returns are calculated considering the compound interest. It’s clearly visible that compound interest helps us to accumulate much larger amount as compared to the simple interest.

The main advantage of the compound interest is that you can start with small amounts and it would amplify into a large corpus over a period of time. But in case if you withdraw your investments early, say within 3 to 4 years of investment, you wouldn’t be taking the advantage the power of compounding.

As interest is earned on both the original principal and the accumulated interest over time, compound interest makes your money grow more quickly. As the initial investments and the income received from those assets rise simultaneously, compounding produces a snowball effect.

Start Early: One of the key takeaways is to start investing at an early age, so that one can benefit at the fullest. The longer your investment horizon, much higher the accumulated corpus would be. The sooner you start saving for the future, you are likely to give more time to your investments to compound and grow. It might enable you to achieve your long-term savings objectives.

While the discussion so far referred to interest income, compounding works for all types of income, so long as the earnings are reinvested to earn further on the same. Let us take the example of SIP in an equity mutual fund.

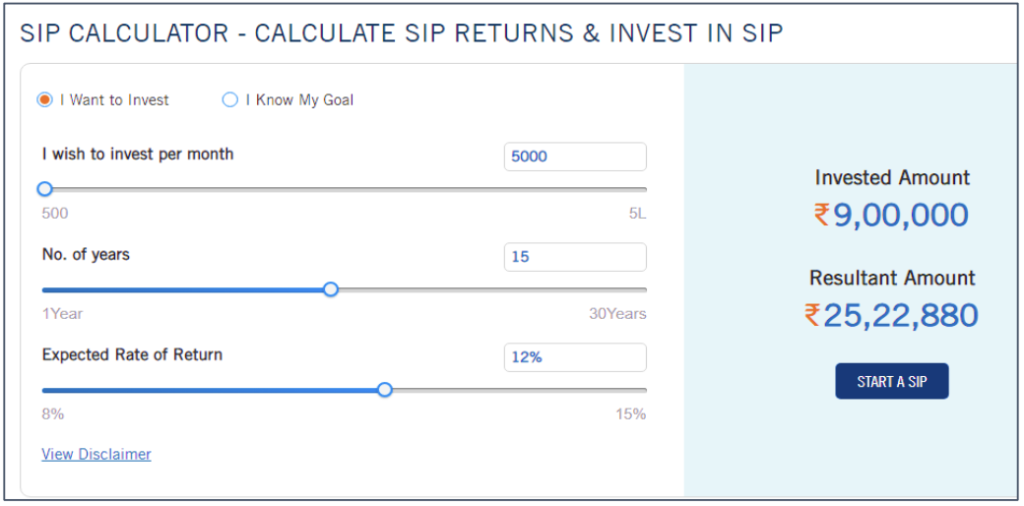

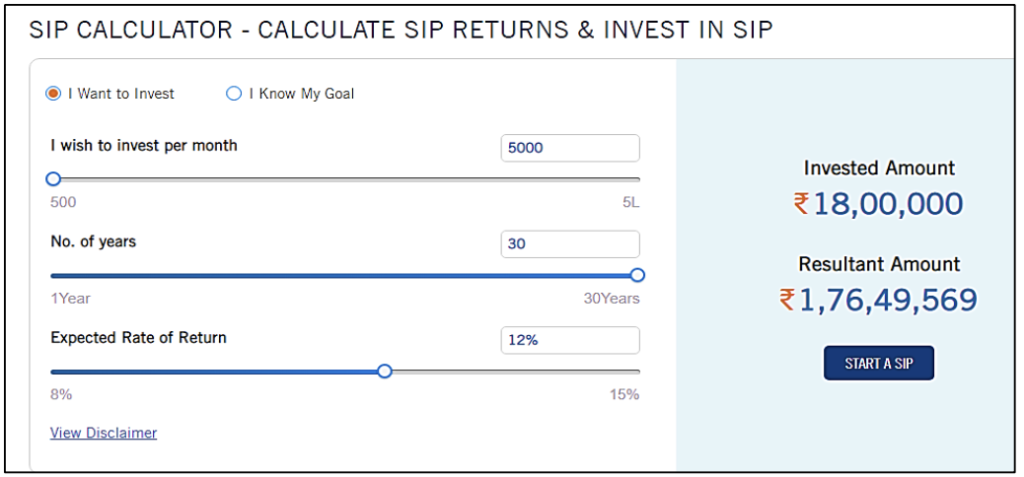

One can start investing small amounts, let’s say they can simply start an SIP (Systematic Investment Plan) of Rs. 5,000/- on a monthly basis for a long-term financial goal.

Suppose an individual starts a monthly SIP of Rs. 5,000 for 15 years and the expected rate of return is taken as 12% p.a., his total investment would be Rs. 9,00,000 and the resultant amount would come to Rs. 25,22,880.

On the other hand, of the investor continues this SIP for say 15 more years, i.e., for a period of 30 years, his total investment would be Rs. 18,00,000 and the resultant amount would come to Rs. 1,76,49,569 (assuming the same rate of return).

From the above example, we can clearly see the power of compounding at work.

The key to wealth creation is a disciplined investment approach and giving your investments time.

Note: The rates of return are only for illustration purpose and should not be construed as any kind of promise or guarantee. Mutual fund investments are subject to market risk. Please read all scheme related documents before investing.