- June 12, 2014

- by Prakash Lohana

- Articles

- 240 Views

- 0 Comments

Life insurance is a very important aspect of financial planning but unfortunately investors are not very clear with primary objective of buying life insurance and how much life insurance they should buy? This article is an effort to bring clarity on these two topics.

Why should one buy Life Insurance?

Normally most of the life insurance policies are bought between January to March, Do you know why? For a simple reason to save taxes. So most of the times investors buy life insurance policies for tax saving and normally insurance consultant is relative or friend and buying policy is an obligation. In India policies are bought with a primary objective of investment and tax saving and due to this people end up paying high premiums, for very low amount of life insurance cover. This is where investors are making serious mistake. This mistake hurts investors in two ways, which is as under.

- They are normally under insured even though they are paying high premiums.

- Due to high life insurance premium which is invested at very low returns their wealth creation process is negatively affected. In my coming articles I will try to quantify the amount of wealth destruction due to this approach.

Life insurance should be bought primarily with objective of life insurance because logically whenever there is death of bread winner, family suffers with two types of losses. One is emotional loss due to death of a family member and second is financial loss due to death of the earning member. When we buy life insurance we transfer this risk of financial loss to Life Insurance Company. Life insurance is primarily needed to replace the income of the earning member of the family who has died. So whenever you are buying a life insurance your primary objective should be maximum risk coverage at low premium and not investment or tax saving.

Don’t buy Life Insurance in the name of Non-Earning members of the family. Also don’t buy life insurance policies in the name of non earning members like wife or children because their death will not cause you any financial loss. On the contrary if you buy life insurance of non earning family members, paying premium will become a burden for them in case if the earning member dies and regular income of family stops.

How to calculate how much Life Insurance you need? It is a very common question asked by investors- how much life insurance I should buy?

Once you are clear with the objective of buying life insurance, next step is how much life insurance one should have? There are different approaches to calculate how much life insurance you need and all approaches have different answers but the prudent approach to calculate how much life insurance one should buy is Needs Approach.

Needs Approach: Needs approach is a method of calculating how much life insurance is required by an individual to cover family needs (all type of expenses and liabilities). It is basically function of following three.

- Total of money required at the time of death to meet all obligations (like funeral expenses, probate cost, Outstanding Loans etc.)

- Present Value of money required to run household expenses in absence of regular income of bread winner.

- Total of present value of money required to meet all big future expenses (like higher education of children, marriages of children etc.).

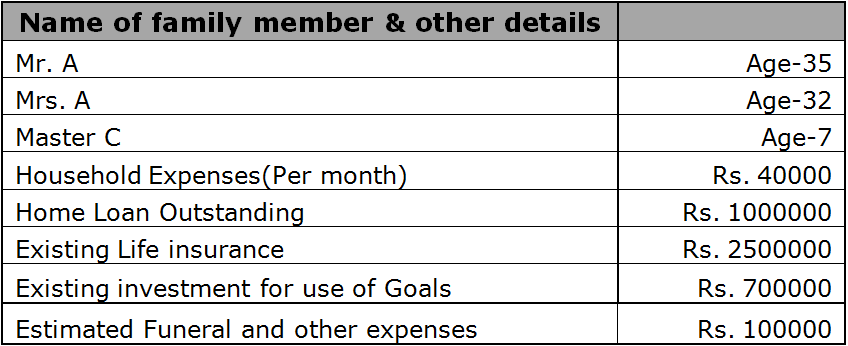

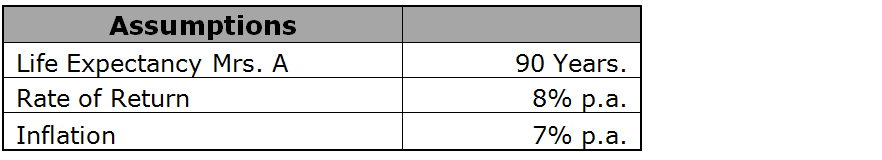

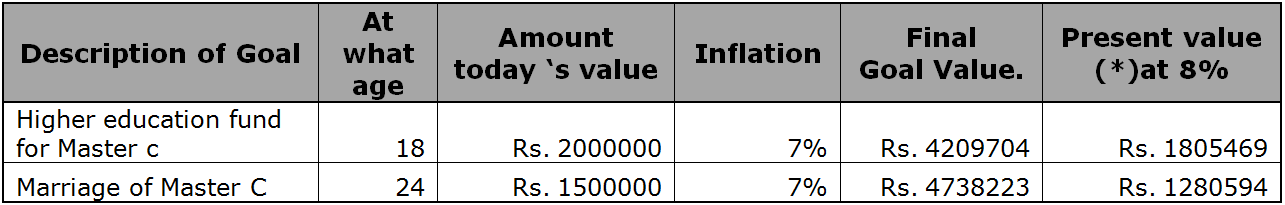

Out of the total of above three we have to subtract sum total of current life insurance and current assets available for use. The figure that is arrived is the insurance need of an individual. So this is how one should calculate his life insurance. Let us see one example of a family to understand with more clarity.

(*) Here present value is the amount received as insurance claim, in case Mr. A dies. This amount if invested at 8% p.a., will become goal value in the goal year.

To calculate your life insurance need please click this link.

http://bit.ly/fundaz100

Now in above case it is clearly visible that Mr. A is bread winner and he requires a life insurance of around Rs. 1.70 crores. Now next question is which insurance policy he should buy. It is advisable to buy term insurance policy.

In above calculation you may see that we have taken credit of existing life insurance and any other additional financial or other assets which are not for consumption and are mainly available for these goals. So as these assets grow, the need for life insurance reduces. If in above case the person has additional assets of say 1 crore available to consume for goals then his life insurance need will be less by 1 crore. So with the growth of assets the life insurance needs will fall. In practical life people take more life insurance as their assets grow which is a wrong approach.

Conclusion: It is very important to understand and calculate how much life insurance one requires, because without that you may either get under insured or over insured. Under insurance is very dangerous and over insurance may add additional cost to your budget which is not required. I would suggest investors to be very clear on their life insurance needs as it is an important part of comprehensive financial planning.