- July 10, 2014

- by Prakash Lohana

- Articles

- 168 Views

- 0 Comments

Before you start reading this article I would insist you to make sure that you read this entire article thoroughly. Because this article can help you to change your investing behavior and this can have a major positive impact on your financial life.

During 10 years of my career as a financial planner, I have met thousands of investors and tried to ask almost every investor this question to check their understanding on equity , unfortunately most of them have invested in equity either directly or through mutual funds but have no clarity about what is equity? And how it works? Investors have basic understanding of real estate, gold and debt but they are very poor in understanding equity and also suffer with lot of myths about equity. Through this article I have tried explain with clarity what equity is? and How it works?

What is Equity?

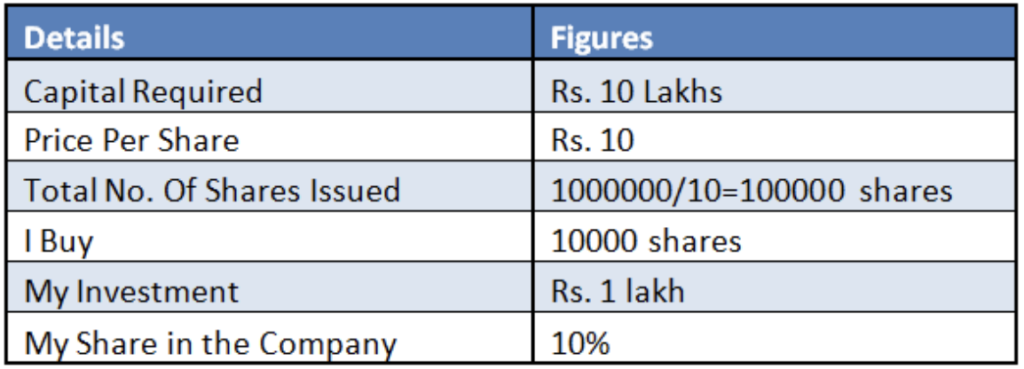

Equity is an instrument of ownership. It is ownership in a business, which is quantified through shares. Let me give you a simple example to understand Equity. Suppose you want to start a business which requires a capital investment of Rs. 1 crore. Now you don’t have 1 crore, so you have two options either you can borrow from bank or you can ask others to invest in your business and become your partner. Now I find the proposal lucrative and by investing Rs 50 lakhs I become 50% partner in your business. This is simple format of partnership but suppose if you required Rs. 100 crores of investment or even more than that. In that case you can create a ltd. Company and bring open offer to become partner (owner) and this offer is quantified in shares. Let me simplify with small figures for better understanding through the following table and example.

As shown in above table suppose you start a company and it needs Rs. 10 lakhs of capital and you offer one share for Rs 10 each. Now, total shares issued will be one lakh as shown in table above. So, if I buy ten thousand shares and invest Rs. 1 lakh in your company I can become 10% owner in your company. This is the exact way equity shares are created.

Equity gives unique opportunity to small investors to invest in bigger business and successful companies. Suppose you want to own a banking business, you will have to first get the banking license from RBI, then you need to invest a big sum of money into that business, you need to understand how to run banking business and it will take years and years to grow. You may not be having so much of time and money to invest. But by buying a few share of a good Bank like HDFC or SBI or ICICI with a few thousand rupees you can become owner of a good running bank. And you don’t need to look after day to day business activities of that company and go into legal hassles of licensing. By investing a few thousand rupees, you can partner a successful company of country. Don’t you think that this is a great business opportunity?

Equity is not an instrument of speculation:

In my seminars and workshop, I find most of the people keep complaining that they have not got good returns in equity. But I want to ask one question to investors that are you looking at equity as ownership instrument with long term perspective? or with a short term speculative perspective. Let us first understand why equity prices move up or down.

Why share Prices move Up or Down?

This question has to be answered in two segments. One for Long term and another for Short term because both have different reasons.

Over Long Term: Over long term share prices may move up or down due to rise or fall in the companies Earning per share (Net profit after tax) and companies Net worth. If company’s Net Profit and Net worth are continuously rising, its share prices will follow it over a long term.

Other factor that affects the share prices over long term is growth in the Networth of the company. Networth is basically excess of assets over liabilities. When a company makes profit, that net profit after tax and dividend is added to shareholders capital in the balance sheet. So when company makes profit net worth increases and when it makes loss net worth reduces. Actually Networth of the company depends on profits of the company so profits and Networth of the company are the factors that drive the prices over long term.

Over Short Term: Over a short term share prices move up and down due to news, views and short term events which normally have no impact or very little impact on company’s profitability over long run. In 2008, Indian stock markets fall by around 60% but profitability of Indian companies or economic activity in the country had not fallen by 60% so this was due to short term events, news and views and emotional reaction of market participants to such events, news and views. This happens, because market participants are emotional human beings their behavior is emotional and not rational.

The father of value investing, Benjamin Graham, explained this concept by saying that in the short run, the market is like a voting machine–tallying up which firms are popular and unpopular. But in the long run, the market is like a weighing machine–assessing the substance of a company. The message is clear: What matters in the long run is a company’s actual underlying business performance and not the investing public’s fickle opinion about its prospects in the short run.

Over the long term, when companies perform well, their shares will do so, too. And when a company’s business suffers, the stock will also suffer.

Conclusion:

I want investors to take atleast following four major takeaways from this article.

- Become an Owner: First and most important, change your attitude towards equity as an asset class and hold it as ownership asset rather than speculative asset. If your business does not do well for a few days or months or even years, you don’t sell it. So, keeps same approach for equity investing also.

- Long Term Approach: Warren buffet in one of his interview said “I never attempt to make money on the stock market. I buy on the assumption that they could close the market the next day and not reopen it for five years.”So, whenever you buy a company stock, buy it with long term approach and don’t look at daily prices. Daily prices are meaningless for long term wealth creation.

- Be Rational and Leave Emotions: This is a golden rule to be a successful equity investor. Leave your emotions away, don’t panic with news and views and similarly don’t become greedy investor. Be rational investor.

- Invest through MF route: while investing in direct shares, you have to be excellent at selecting companies. This is not your job so leave it to fund managers of Mutual Fund Companies.