- September 18, 2014

- by Prakash Lohana

- Articles

- 185 Views

- 0 Comments

Earlier I had published an article on What is Financial Planning? and How Financial Planning process works? On Now this article is an effort to differentiate between Traditional Transactional Investment Approach vs. Financial Planning Approach.

Traditional Approach of Investment:

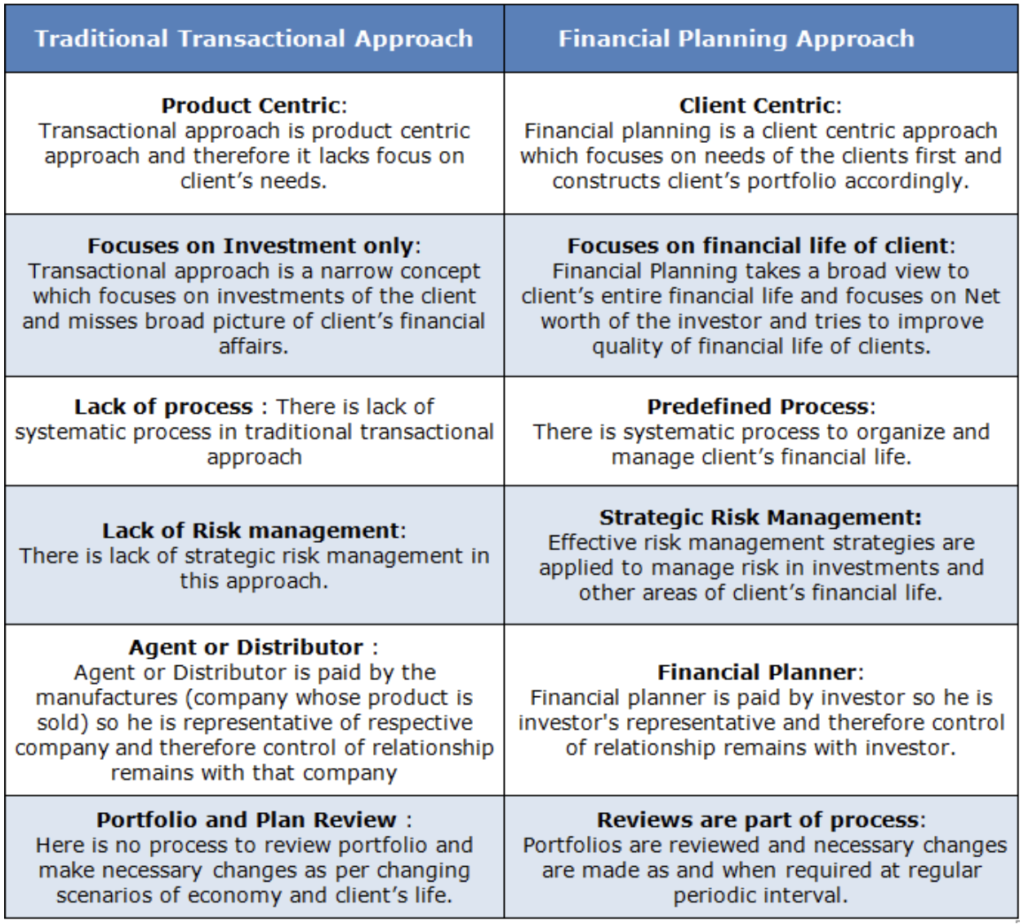

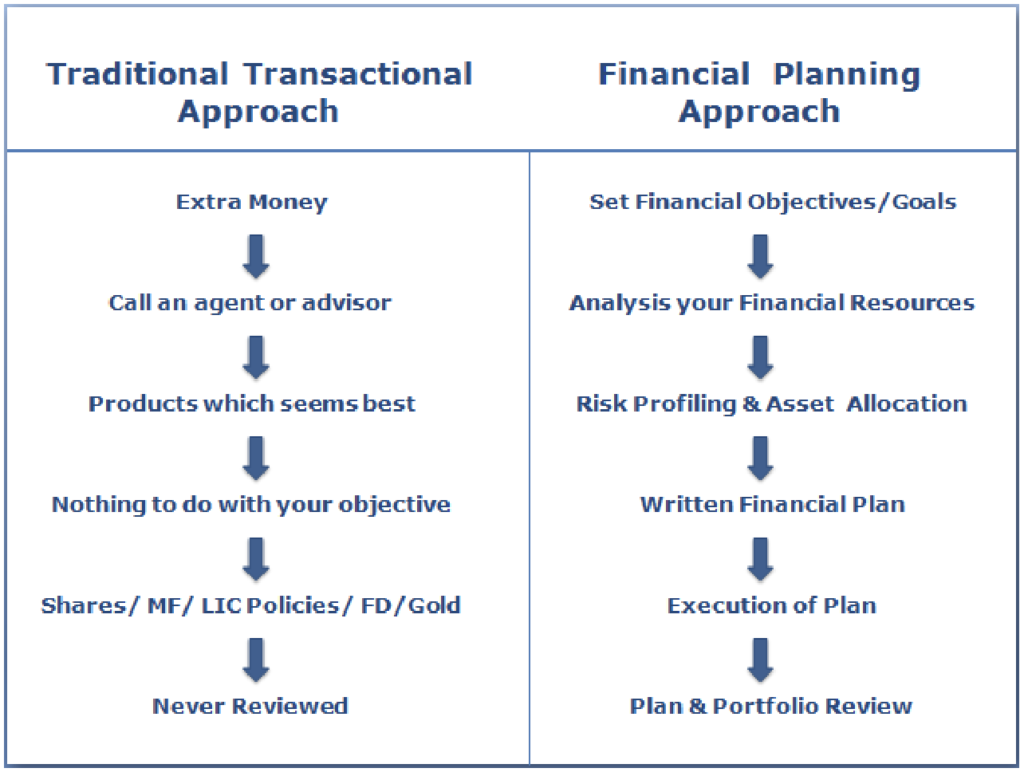

Traditional Transactional Approach is the approach that most of the people in India adopt for making and managing their financial affairs. In this approach investors follow a typical sequence of action which I have mentioned here above in a chart and explained thereafter.

At first, whenever they have additional surplus money, they will call an advisor who is actually an agent or distributor of different financial products and ask for advice. The money will be invested in the best looking asset class and financial product at that point of time. By best looking, I mean to say that if equity markets are doing very good it will be invested in direct stocks or equity mutual funds, if in recent past gold prices have gone up sharply it will be invested in physical gold or gold ETF, if bonds have done good in recent past than money will be invested in bonds.

Now these financial products have nothing to do with long term or short term objectives of the investor. Academic qualification, knowledge, process of this advisor is never given any importance. Further after making this investment it is never reviewed whereas finance is one of the most dynamic areas so ideally it should be periodically reviewed.

This approach is a disasters approach because first of all investors select the product or asset class which has done very well in the recent past. If you will go through the history, in 2007 when equity markets were overvalued most of the investors invested in equity due to this process and in 2008-09 when equity markets were undervalued they invested in bonds and other assets. These investments are never made considering clients long-term or short term financial objectives. Suppose client wants to invest for one year and if equity markets are doing good money will be invested in stock market, which is a wrong decision. Due to this investors are not able to earn decent risk adjusted returns.

From where do we learn this approach? One question that comes is why investors normally in more than 99% cases adopt this approach. The answer is we don’t have personal finance education any where in our formal education system so most of the things we learn in personal finance is from our parents and we have never seen our parents doing effective Financial Planning or hiring any qualified financial planner and making written financial plan to manage their financial life. That’s why I call this approach Traditional approach.

Financial Planning Approach:

Against this Financial Planning approach is a much organized and process driven and disciplined approach. As shown in the image in Financial Planning approach, a qualified financial planner follows a six step process which works for the investors as under.

1. Setting up Goals/Objectives: First step of Financial Planning is setting up clear financial objectives and goals. Financial objectives are like a destination where you want to reach. When people don’t have clear financial objectives at the time of investment and try to search for best investment options, it is like someone reaches railway station and asks which train is the best train today. This type of investors most of the times select asset classes and products which are not suitable to their needs.

Clearly set financial goals and objectives are helpful in deciding direction and speed that a client needs to maintain in his portfolio. It gives clear idea about investment horizon and so one can setup effective mix of asset classes like Equity, Bonds etc. and construct a very good portfolio as per the needs of the investor.

2. Analysis of Financial Resources: Once the goals of the client are clearly set, advisor knows where the client actually wants to reach. At second step advisor tries to analyze existing and future resources of the investor. This helps him to understand where client wants to reach and where he is right now so what speed and direction is exactly required. At this stage advisor takes details of income, expenses, assets, liabilities , exiting investments etc. from the client and works out mathematically whether client can reach his goals comfortably or not .If there is any gap and client cannot reach his goals he will do gap analysis and prioritization between different goals.

3. Risk Profiling & Asset Allocation: At this stage risk profiling of client is also done. Risk profiling is the process of deciding what percentage of client’s investment should be in aggressive asset classes like Equity and Real Estate and what should be in conservative asset classes like Bonds. Risk profiling helps to derive optimum risk level for the client. This mainly depends upon three factors, his ability to take risk, his need to take risk and his willingness to take the risk. Client’s ability and need are financial characteristics whereas his willingness is psychological characteristic. After Risk Profiling asset allocation is done so at this level it is clear for the client what will be his allocation to different asset classes like Equity, Debt, Gold etc.

4. Written Financial Plan: After Risk profiling and asset allocation, financial plan of the investors is discussed and finalized with him. Here the financial plan that is given to client is in the written format. So, all the advice that is given in Financial Planning approach is written advice. Have you ever seen doctor giving oral diagnosis and prescription? Never, so it is my strong advice to investors to take all the advice from their financial advisor in written format and never accept oral advice. At this stage investor also gets recommendation on portfolio and products. So in Financial Planning approach, products come last whereas in Traditional Transactional Approach products come first.

5. Execution of Financial Plan: Mere planning doesn’t ensure financial success so once the plan is ready investors should start execution as per the plan.

6. Plan and Portfolio Monitoring and Review: In Financial Planning approach, portfolio is reviewed at periodic interval. This helps investors to keep their financial health continuously intact. Portfolio review includes review of asset allocation and products at regular frequency say half yearly or quarterly and also monitoring execution of plan.

One more benefit of Financial Planning approach is, your financial plan is reviewed at least once a year. Your financial plan is made based on certain assumptions related to your income, expenses , assets, liabilities and many other factors and your circumstances so a plan that is made once need revision and adjustment for all these factors at least once a year which is taken care in Financial Planning approach.

Conclusion:

I would say that as an investor you should understand one thing that your financial life is like a test match and not a Twenty-Twenty . Normal Transactional Approach will work like a Twenty-Twenty match and lead you nowhere, it will always keep you confused and finally end up with major mistakes in your financial life. Whereas, Financial Planning is a disciplined approach with predefined process which will take you to your financial goals smoothly. Following are some major differences from the point of view of investors between Transaction approach vs. Financial Planning approach.