- April 10, 2015

- by Prakash Lohana

- Articles

- 188 Views

- 0 Comments

Are  you sure that if you die today your family will be able to survive and enjoy same life style that they are enjoying now ? All the capital expenses like your children’s education & higher education expenses, marriage expenses and all other type of expenses will be mate properly?, your wife will not have to look here and there for meeting these responsibilities and day to day expenses?, All your loans and liabilities will be paid of immediately?

you sure that if you die today your family will be able to survive and enjoy same life style that they are enjoying now ? All the capital expenses like your children’s education & higher education expenses, marriage expenses and all other type of expenses will be mate properly?, your wife will not have to look here and there for meeting these responsibilities and day to day expenses?, All your loans and liabilities will be paid of immediately?

Yes or No?

Most of the people don’t have clear answer about this.

Let me tell you why?

Most of you have never planned your life insurance with this approach. Most of the Indians by life insurance policies either as investment products or as a tax planning instruments and forget the basic objective of protecting family through life insurance in the times when they are not there.

Please remember that I am not trying to promote you any life insurance policy and I am not an insurance agent. I am just trying to make you realize a real fact which most of the investors keep avoiding. But If you are buying life insurance without considering all above factors then you are doing injustice to your family. would you like if your wife has to work hard for monthly expenses in case of your uncertain death or your children have to select a college which is cheaper in terms of fees but also poor in quality of education it provides?

I don’t think you would like that so then what should be done? You should adopt Needs approach to calculate how much life insurance your need and which type of life insurance policy you should buy to meet that need.

What is Need Based Approach?

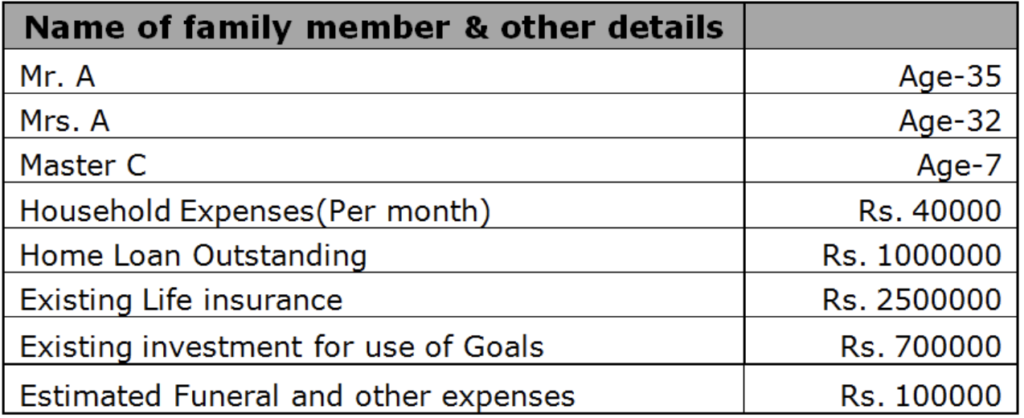

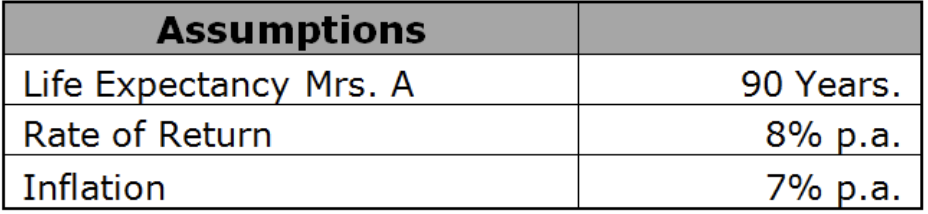

Needs Approach: Needs approach is a method of calculating how much life insurance is required by an individual to cover family needs (all type of expenses and liabilities). It is basically function of following three.

- Total of money required at the time of death to meet all obligations (like funeral expenses, probate cost, Outstanding Loans etc.)

- Present Value of money required to run household expenses in absence of regular income of bread winner.

- Total of present value of money required to meet all big future expenses (like higher education of children, marriages of children etc.).

Out of the total of above three we have to subtract sum total of current life insurance and current assets available for use. The figure that is arrived is the insurance need of an individual. So this is how one should calculate his life insurance. Let us see one example of a family to understand with more clarity.

(*) Here present value is the amount received as insurance claim, in case Mr. A dies. This amount if invested at 8% p.a., will become goal value in the goal year.

Now in above case it is clearly visible that Mr. A is bread winner and he requires a life insurance of around Rs. 1.70 crores. Now next question is which insurance policy he should buy. It is advisable to buy term insurance policy.

In above calculation you may see that we have taken credit of existing life insurance and any other additional financial or other assets which are not for consumption and are mainly available for these goals. So as these assets grow, the need for life insurance reduces. If in above case the person has additional assets of say 1 crore available to consume for goals then his life insurance need will be less by 1 crore. So with the growth of assets the life insurance needs will fall. In practical life people take more life insurance as their assets grow which is a wrong approach.

Now how to calculate your own life insurance like we calculated life insurance of Mr. A In above case?

The solutions is you can send me few details required for calculation and I will give you the figure of life insurance required in your case along with the detailed calculation.

For sending me your details click this link attached here and download an excel sheet. Fill the details required and send me back on lohana_prakash@ascentsolutions.in let me know if you have and doubts.

Once I receive your details i will send you your life insurance requirement along with the detailed calculation sheet then you can buy life insurance either through your agent or online.