- April 16, 2014

- by Prakash Lohana

- Articles

- 490 Views

- 0 Comments

Succession Planning is a very important aspect of overall financial planning. But it is being observed that Indians are very poor at this topic and they generally avoid planning for their inheritance. Being a financial planner I come across number of clients and when I discuss with them whether they have planned how their Wealth will be passed on, they are never clear and have lots of misunderstanding about this concept. This article is an effort to bring some clarity on what happens if one dies without a valid will?

What happens if one dies without valid Will?

In India, as per the provisions of Indian Succession Act, 1925 if one dies without writing a valid will, he is said to be died intestate and his property will be distributed as per the provisions of the succession law applicable to him. So if you want that your hard earned wealth should be distributed as per your wish it is important to write proper will. In India, Hindus, Sikhs and Jains are covered under Hindu Succession Act 1956 and Indian Succession Act, 1925. Muslims are governed by their Muslim Law. Christians, Parsis and Jews are governed by Indian Succession Act, 1925.

If Hindu Male Dies Without Will.

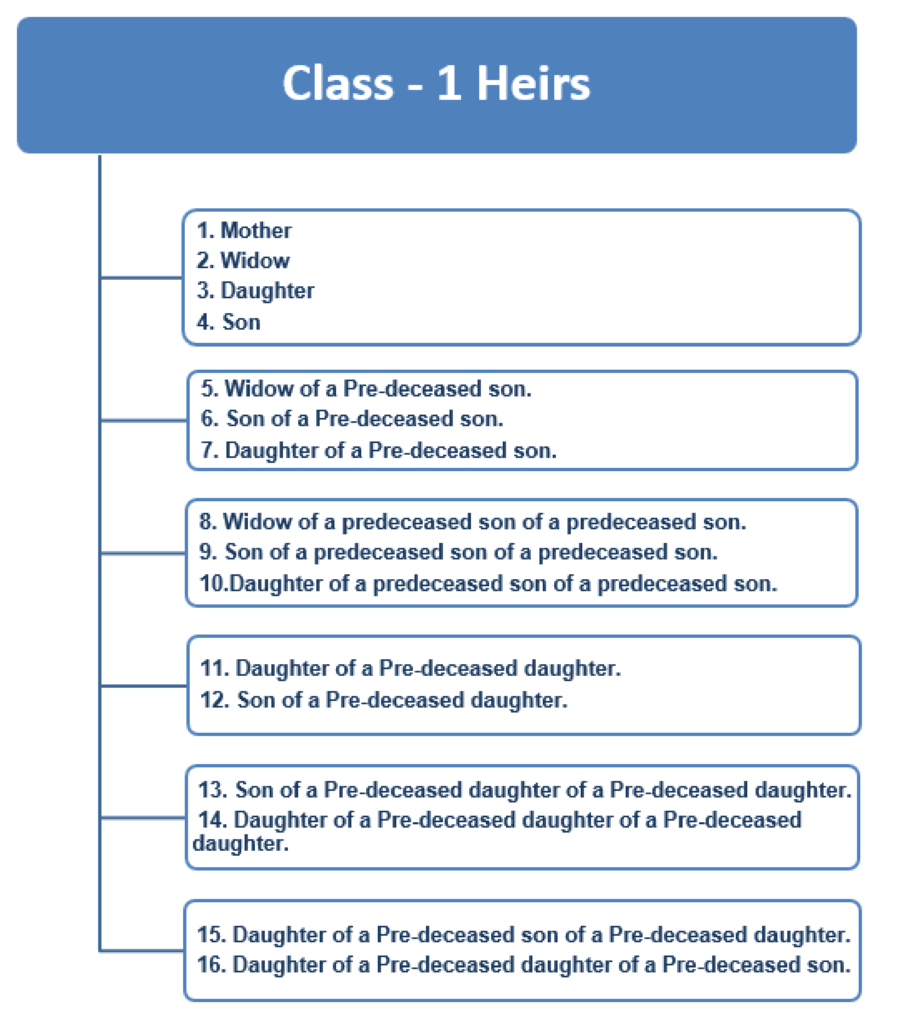

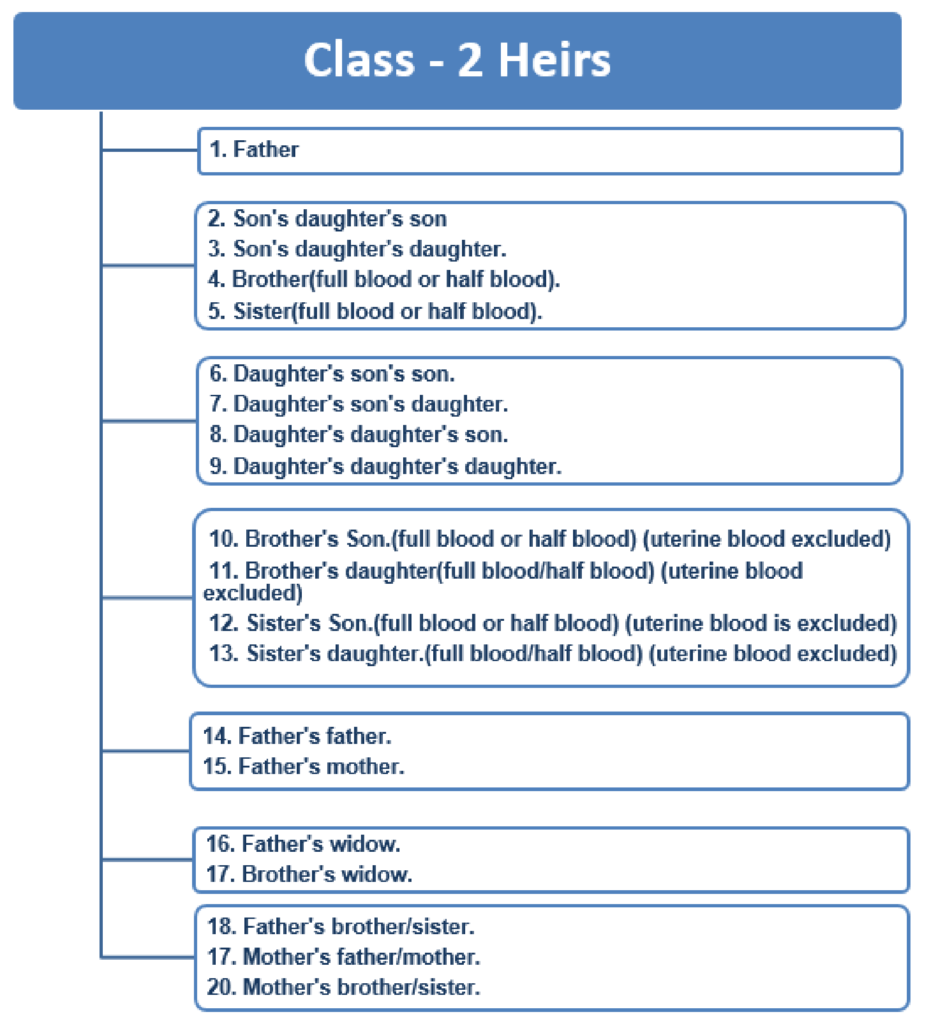

Let us see how wealth will be distributed if a person with Hindu religion dies without a valid will. In case of a Hindu male if he dies without a valid will his wealth will be distributed as per the provisions of Hindu Succession Law first to Class 1 Heirs equally and if there are no Class 1 then to Class 2 Heirs. Following is the list of Class 1 and Class 2 Heirs;

What if Both Class 1 & Class 2 Heirs are Missing?

In the absence of heirs of Class 1 and Class 2, the property is passed to the agnates and cognates of the deceased in succession. Between agnates and cognates, agnates are preferred over cognates.

Agnates : Agnate means a person related to wholly through males either by blood or by adoption. The agnatic relation may be a male or a female. One’s father’s brother, or father’s brother’s son or father’s son’s son or father’s son’s daughter are agnates. So the final relationship may be male or female but it must be through males. The relationship can also be in ascending or descending line.

Cognates : Cognates means a person related not wholly through males. Where a person is related to the deceased through one or more females, he or she is called a cognate. Thus son’s daughter’s son or daughter, sister’s son or daughter, mother’s brother’s son, etc. are cognates. Here also the final relationship may be male or female but there is at least one female in that line of relationship.

Note that if there are more than one Widow’s , then they get one share only and then divide it between themselves and a person immediate family will also be considered as one unit only.

If Hindu Female Dies Without Will

If a Hindu Female dies without writing a valid will then her own wealth will be distributed as under;

- Firstly, upon the son and daughters and the husband.

- Secondly, upon the heirs of the husband.

- Thirdly, upon the mother and father.

- Fourthly, upon heirs of the father.

- Lastly upon heirs of the mother.

Property acquired from Husband If the women has acquired any property from her Husband, in that case the first right will be of the heirs of her husband, in case of absence of his sons or daughters.

Property acquired from Father or Mother If the women has acquired any property from his Father or Mother, in that case the first right will be of the heirs of her father and not husband, in case of absence of his sons or daughters.

Conclusion:

So it is clearly evident that we as financial planners should encourage our clients to write a proper “WILL” because in absence of the valid will his/her hard earned wealth will be distributed as per the provisions of law. Further when there is no clear will, it can lead to a situation where there can be disputes between family and it can take few years to resolve so it is very much advisable to ensure our clients have a proper will in place.